Learning how to start a small business in Malaysia opens up exciting opportunities for growth, innovation, and market reach.

While navigating regulations and setting up operations can seem challenging, the guidance by provider turns these steps into manageable actions, empowering entrepreneurs to launch confidently and focus on growing their business.

Amaze Advisory specialises in helping entrepreneurs and SMEs navigate the complexities of business setup, with corporate business solutions, company incorporation services in Malaysia, and company registration in Malaysia for foreigner.

Key Takeaways

- Setting up a start-up in Malaysia requires a valid business address, minimum paid-up capital, and compliance with local tax and labor laws.

- The main business entities in Malaysia are Enterprise (for small businesses), Sdn Bhd (for limited liability and scalability), and LLP (for professional partnerships).

- Follow the necessary steps to establish your business and ensure it’s legally compliant and ready for growth.

7 Key Requirements for a Successful Small Business Start Up in Malaysia

Starting a business in Malaysia requires meeting several fundamental criteria to ensure compliance with the country’s legal and regulatory frameworks. Here are the key requirements:

1. Business Ownership & Age Requirements

The business owner must be at least 18 years old.

For foreign entrepreneurs, the requirements may vary based on the business structure, especially for companies like Sdn Bhd (Private Limited), where at least one local director is needed.

2. Business Structure Selection

Entrepreneurs need to choose the appropriate business structure, such as an Enterprise (sole proprietorship or partnership), Sdn Bhd (Private Limited), or LLP (Limited Liability Partnership).

Each structure has different implications for liability, tax, and operational flexibility.

3. Company Address

A registered business address in Malaysia is mandatory. This can be a commercial or residential address, but it must be within the country.

4. Minimum Paid-Up Capital

The minimum paid-up capital for a Sdn Bhd company is RM1,000, though certain industries may require higher capital.

Paid-up capital represents the owner’s investment in the business and serves as a financial foundation for operations.

5. Local Directors & Shareholders

You must appoint at least one local director (a Malaysian resident) for a Sdn Bhd.

Foreign owners can hold 100% ownership, but the director must be a Malaysian citizen or permanent resident.

Learn more about how the nominee director role can simplify your business establishment process in Malaysia.

6. Compliance with Local Regulations

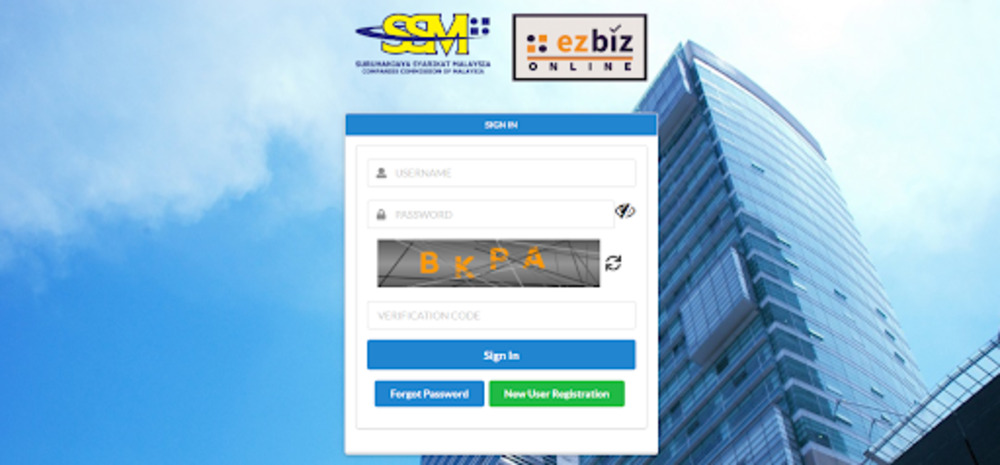

Businesses must register with the Suruhanjaya Syarikat Malaysia (SSM), the governing body for companies in Malaysia. This includes submitting required documents like the company’s constitution, director information, and business address.

Registration with the Lembaga Hasil Dalam Negeri (LHDN) for tax purposes is necessary. This includes corporate tax and, in some cases, the Sales and Service Tax (SST),.

7. Other Permits & Licenses

Depending on the industry (e.g., F&B, construction, education), additional licenses or permits may be required from relevant authorities such as the local city council or the Ministry of Health.

Contact Amaze Advisory for more information about how we can help you setup your company along with registration.

Pick the Right Business Structure for Your Small Business Start Up

Selecting the right business entity is one of the first decisions you’ll need to make when starting a small business in Malaysia. Your choice will influence the level of personal liability, tax obligations, and the potential for business growth.

Below is a comparison of the most common business structures in Malaysia:

|

Business Entity |

Description | Advantages |

Disadvantages |

|

Enterprise (Sole Proprietorship / Partnership) |

A simple structure for a single business owner or two or more partners. Common for small businesses. |

|

|

|

Sdn Bhd (Private Limited Company) |

A separate legal entity where shareholders’ liability is limited to their shareholding. Suitable for businesses looking to scale. |

|

|

| LLP (Limited Liability Partnership) |

A hybrid business structure combining elements of a partnership and a company. |

|

|

Launch Your Business in Malaysia with Amaze Advisory

Amaze Advisory specialises in providing corporate business solutions, company incorporation services in Malaysia, and company registration in Malaysia for foreigner to help entrepreneurs navigate the complexities of starting a business in Malaysia.

Our step-by-step guide for company formation in Malaysia ensures your start-up is set up legally, efficiently, and ready for growth, with expert support at every stage.

Step 1: Business Entity Selection

Selecting the appropriate business entity shapes your company’s structure and growth potential. The most common options available include:

- Enterprise (Sole Proprietorship/Partnership): Best for small, low-risk businesses.

- Sdn Bhd (Private Limited Company): Ideal for businesses looking to scale and limit personal liability.

- LLP (Limited Liability Partnership): A hybrid structure offering flexibility and limited liability.

We provide expert advice to help you select the best business entity, ensuring your start-up is aligned with your long-term goals.

Step 2: SSM Registration & Setup

Once you’ve chosen your business entity, register with the Suruhanjaya Syarikat Malaysia (SSM) for company name approval. The registration process includes:

- Business Name Search to ensure the name is unique.

- Document Submission including Form 9, 24, and 49 (for Sdn Bhd).

- Digital Signature setup for company directors.

- Payment of Registration Fees.

Our team at Amaze Advisory handles all the paperwork and submission, ensuring your registration is seamless and timely.

Step 3: Open a Company Bank Account

After registering your business, opening a business bank account is the next step. Requirements include:

- SSM business registration certificate

- Identification documents of directors

- Company resolution for opening an account

Our accounting and bookkeeping services will guide you through the best options for opening a business account and ensure you have all the necessary documents.

Step 4: Paid-Up Capital Declaration

For Sdn Bhd companies, you must declare a minimum paid-up capital, typically at RM1,000. This amount may vary depending on your business sector.

We advise you on the optimal paid-up capital based on your business’s size and goals.

Step 5: Tax Registration & Compliance

Register with Lembaga Hasil Dalam Negeri (LHDN) for corporate tax and, if applicable, Sales & Service Tax (SST). Malaysia is also moving towards mandatory e-invoicing, which your business must comply with.

Our experts at Amaze Advisory provide tax compliance services that ensure your tax registration and e-invoicing system are in place so your business meets all legal requirements.

Step 6: EPF, SOCSO & EIS Registration

If you hire employees, registering for the Employees Provident Fund (EPF), Social Security Organisation (SOCSO), and Employment Insurance System (EIS) is essential.

Let Amaze Advisory simplify the process through our Employer of Record services and HR and payroll outsourcing, ensuring compliance with Malaysian labour laws.”

Learn more about EOR vs PEO, as well as understanding payroll with EPF, SOCSO, and EIS, to ensure your business is fully compliant and efficiently managed.

Step 7: Business Licences and Permits

Depending on your industry, you may need sector-specific licenses or permits, such as:

- Health licenses for F&B businesses

- Retail permits for physical stores

- Construction-related permits for building contractors

Amaze Advisory will assist you in obtaining the necessary licenses, saving you time and ensuring full compliance.

Step 8: Operational Readiness

Once your business is legally established, it’s time to get operationally ready:

- Set up Accounting Software to manage finances effectively.

- HR and Payroll Setup for employee management and statutory contributions.

- Website & Digital Presence to market your business online.

We help you set up the right operational tools, ensuring your business is ready to thrive.

Starting a business in Malaysia is a lucrative opportunity, and with Amaze Advisory, you can launch quickly and confidently.

Let us handle registrations, compliance, and operational setup to ensure your business is fully ready to operate and grow.

Contact Amaze Advisory today and take the first step toward building your business in Malaysia.